indiana state tax warrants

The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants. The Indiana State Tax Warrants are downloaded to the Clerks Office computer system from the state level.

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

The judge then issues a warrant.

. Ad Search Warrant Records Access Cases Released Warrant Documents With A Name State. The court will deem the bail bond forfeited and issue the. Our service is available 24 hours a day 7 days a week from any location.

In order to qualify for an. Helps eliminate BAD ADDRESSES by sending them back to IDOR. If you have a warrant issued for you it is because you did not show up to court on the appointed day.

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. Keeps a constant history of all notes payments notifications sent. What can I do to be sure I am meeting all Indiana tax obligations for my business.

A Tax Warrant is not an arrest. An arrest warrant is a written command that permits law enforcement to seize the individual specified and bring him or her before a judge to answer for the offense they. If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of the warrant.

Ad 2022 Official Updated Database -Find All Warrants for Anyone. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Although tax warrants no longer receive court case numbers circuit clerk s must ensure that tax warrant information is available to the public in some manner.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. My pension is from a company based in another state. What is a tax warrant.

Although this is not. An outstanding warrant from Indiana will have a fixed format and will include information about the issuing entity as well as the person who is to be arrested. These taxes may be for individual income sales tax withholding.

Also called a lien the warrant is a public. A Tax Warrant is not an arrest. Tax warrants are filed when tax liabilities have not been paid and demand notices have generated.

Under IC 6-81-3 and IC 6-81-8-2. The Indiana Department of Revenue DOR has the right under certain parameters to issue a tax warrant. Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR.

About Doxpop Tax Warrants. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

Indiana State Tax Warrant Information. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. Tax Warrant for Collection of Tax.

These should not be confused. The Clerks office has a public terminal that you can use to access these records. What state is it taxed in.

With a subscription to the Tax Warrant Application on INcite managed by the Office of Trial Court Technology users can get secure access to tax warrant information maintained by the Clerks. Under IC 6-81-3 and IC 6-81-8-2. The tax warrant can exist for the amount of unpaid taxes as well as interest penalties.

In Indiana judges can issue a bench warrant if a defendant fails to appear in court upon a bail admission Indiana Code 35-33-8-7. Doxpop provides access to over current and historical tax warrants in Indiana counties. A tax lien in the state of Indiana is a judgment that occurs once a tax warrant is filed.

As part of the Tax Amnesty 2015 program eligible taxpayers are allowed to submit a request to have tax warrants expunged from their records. Keeps a running balance of each warrants amount due. Indiana warrants must be dealt with immediately.

This could be done by providing.

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

Indiana Dept Of Revenue Inrevenue Twitter

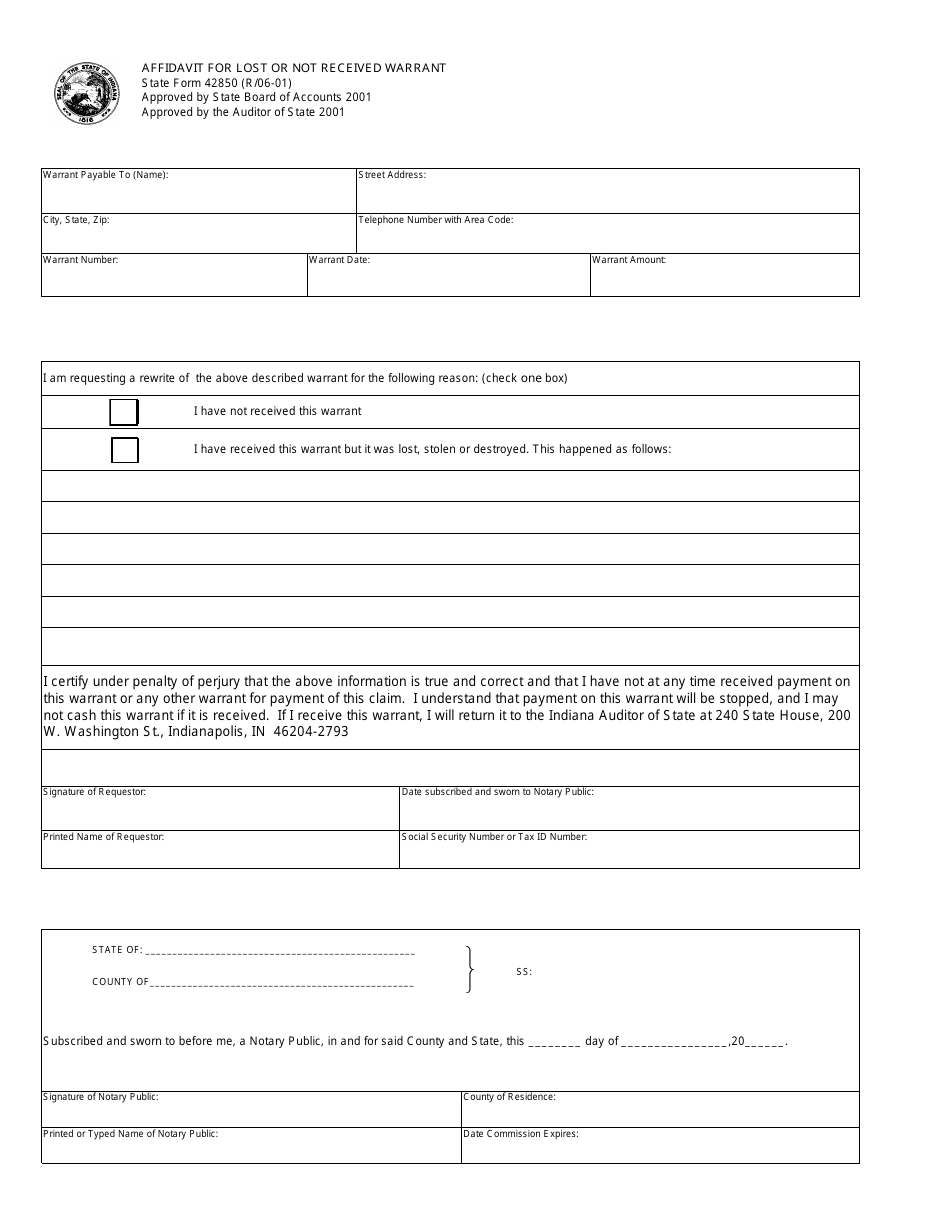

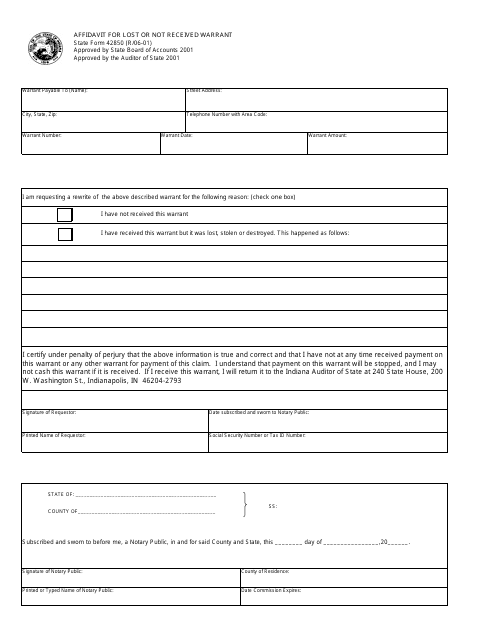

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Indiana Tax Relief Information Larson Tax Relief

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

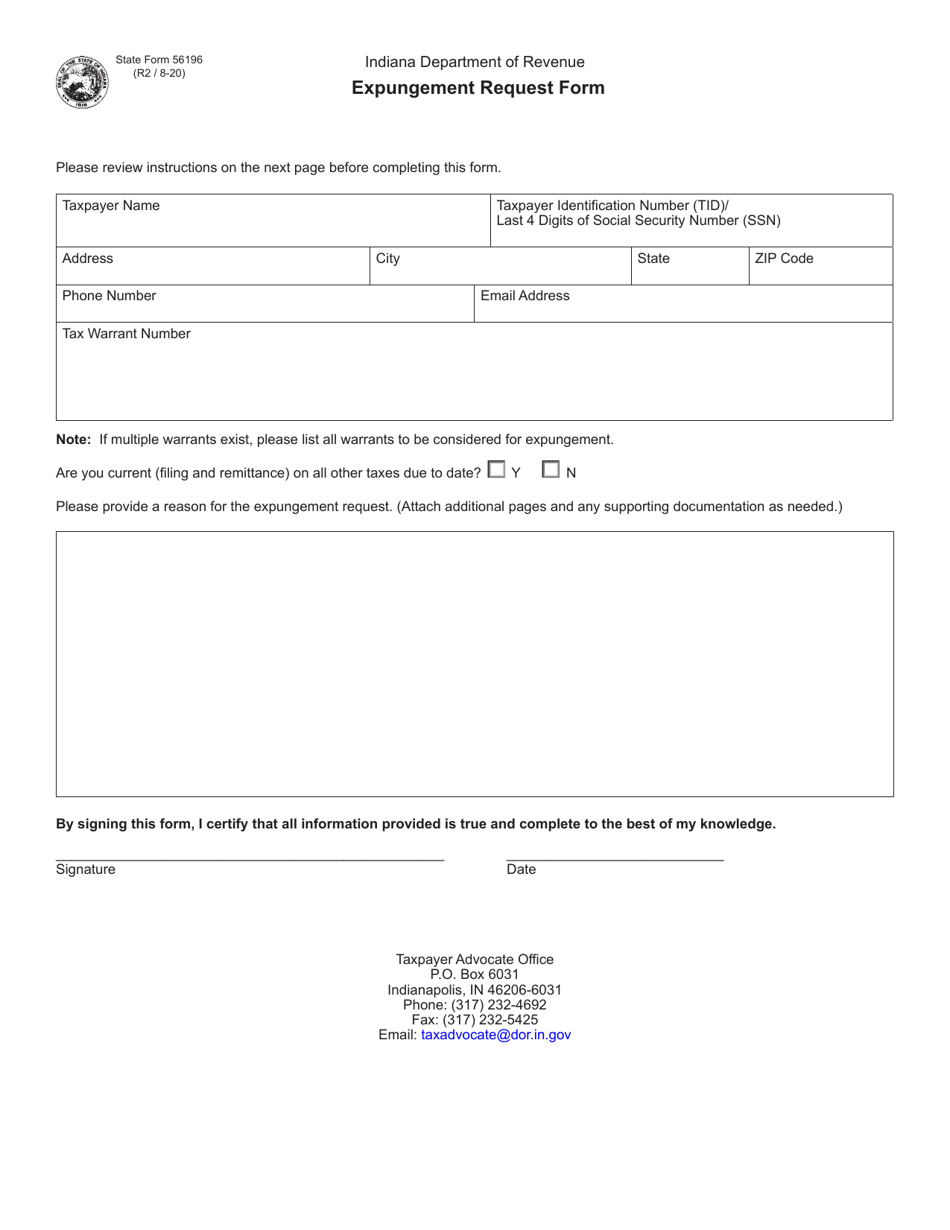

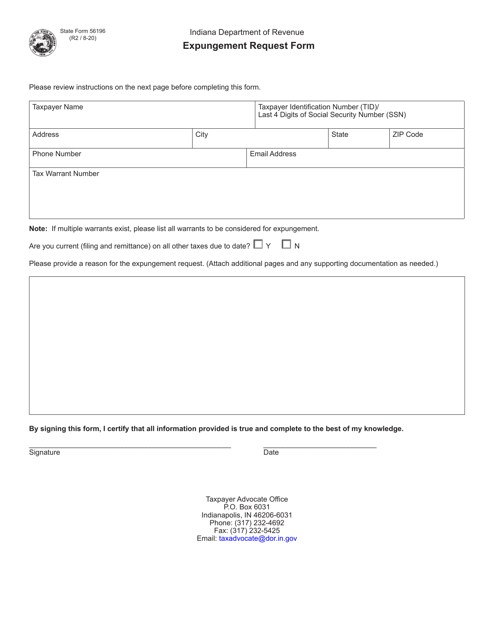

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Tax Warrants Hamilton County In

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

Indiana Warranty Deed Fill Online Printable Fillable Blank Pdffiller

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly